AI’s arrival in M&A is no longer a theoretical pitch, it’s an everyday tool for smart dealmakers navigating oceans of data, soaring complexity, and relentless competition (IEEE; TCS). From faster deal sourcing to sharper diligence, AI promises more precision and scale than traditional methods ever could. But is the hype justified?

This piece unpacks what AI does well, where its limits lie, and how human judgment, legal clarity, and data discipline remain vital for real value creation.

Why AI, Why Now?

The Data Imperative :

- Tens of thousands of global targets.

- Noisy, unstructured signals buried in filings, news, and social feeds.

- Regulatory and geopolitical shifts that evolve daily.

AI’s convergence of machine learning, NLP, and automation gives deal teams a way to distill clarity from chaos (DealRoom; McKinsey).

AI Is Changing the M&A Lifecycle

Deal Origination

• Predictive pattern recognition spots likely targets using historical transaction data, patents, and sector signals (arXiv).

• NLP tools generate personalized sourcing recommendations.

Due Diligence

• AI automates contract reviews, flags risks, and extracts hidden clauses (IJRASET).

• Generative AI drafts summaries, maps risks, and creates first-pass reports.

Valuation and Risk

• Multimodal models find patterns humans miss (arXiv).

• AI flags hidden operational and compliance risks.

Negotiation Support

• Scenario simulations and game theory forecasting inform counteroffers (SAGE).

• Automated contract term drafting speeds up deal flow.

Post-Merger Integration

• AI maps integration synergies and predicts cultural impacts (Akira).

• Smart agents track project milestones and workforce risks.

AI is no longer an emerging add-on in the deal making process; it is becoming a core differentiator. Forward-looking firms are embedding AI across the transaction lifecycle, not just to streamline tasks, but to sharpen strategic judgment and accelerate value capture.

As M&A grows more complex, the ability to harness AI effectively may well define the next generation of market leaders.

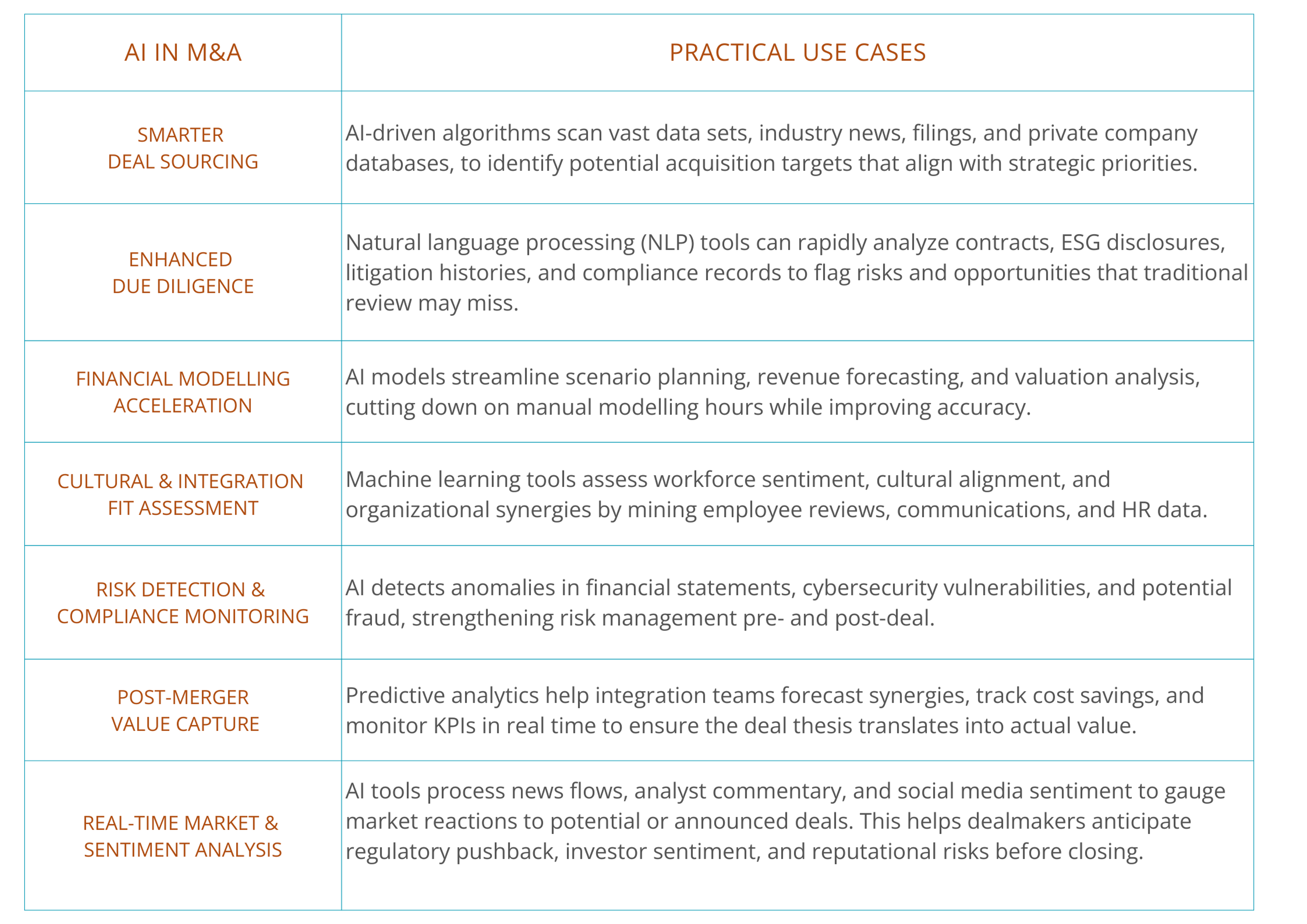

The following seven use cases illustrate how these technologies are reshaping the deal playbook in practice :

Where AI Falls Short

• Data quality matters: Poor or biased data can mislead AI (ACM).

• Lack of nuance: Algorithms can’t read body language or subtle signals in trust-heavy negotiations (Aligned Negotiation).

• Privacy and cyber risks: AI’s appetite for sensitive data demands tight safeguards (Mercer).

• Regulatory friction: Cross-border AI use triggers antitrust, IP, and data privacy hurdles (Mondaq).

• Black box bias: AI’s decisions can be opaque, making transparency and audits critical (Reed Smith).

Real Deals, Real Lessons

- Salesforce - Tableau: AI-driven analytics shaped valuation and synergy mapping (Fast Company).

- IBM - Red Hat: Machine learning surfaced cloud integration value streams (McKinsey).

- Microsoft - Nuance: AI insights revealed sectoral overlaps in healthcare NLP (EWADirect).

What’s Next : Beyond the Hype

Deeper hybrid teams : AI crunches, humans strategize (INSEAD).

Predictive sourcing at scale : Next-gen agents pull wider, real-time signals (Growthpal).

Built-in compliance : AI will bake in regulatory guardrails by design (Fieldfisher).

Integration enablers : AI will steer talent retention and cultural fit alongside operations (Relevance AI).

AI will never replace human judgment, but smart teams that blend algorithms with experience, rigorous governance, and clear ethics will win the next decade of deal-making.

At Yajur Knowledge Solutions (yajurks.com), we help clients deploy AI intelligently, as a precision tool to find opportunities, de-risk decisions, and execute deals that stand up to real-world scrutiny.

References

- ACM Digital Library. (2025). AI Audits

- Aligned Negotiation. (2025). AI in Negotiations

- arXiv. (2024). Predicting M&A

- arXiv. (2024). Valuation Insights

- DealRoom. (2025). AI in M&A

- EWADirect. (2025). Microsoft–Nuance

- Fast Company. (2024). New Era of M&A

- Fieldfisher. (2025). AI and Risk

- Growthpal. (2025). Future of Deal Sourcing

- IJRASET. (2024). AI in Financial Integration

- INSEAD. (2025). Power of AI

- McKinsey. (2025). GenAI Opportunities

- Mercer. (2025). People Risks

- Mondaq. (2025). AI Legal Risks

- Reed Smith. (2025). AI Due Diligence

- Relevance AI. (2025). Integration Agents

- SAGE Journals. (2025). AI and Negotiation

- TCS. (2025). AI Algorithms in M&A

- Acuity Knowledge Partners. (2024). Transaction support and AI in private credit.

- PwC. (2023). AI in deals: Transforming M&A through artificial intelligence.

- KPMG. (2024). M&A in the age of AI.

- Deloitte. (2023). How AI is reshaping M&A strategies.

- Magistral Consulting. (2024). Deal execution in private equity: What’s changing and why it matters.